Life science is an important business area for Sweden. In order to be able to identify trends and development needs, Vinnova has been commissioned to follow Swedish life science companies on an annual basis. This is a first report, where we can see, among other things, that life science is a strongly growing sector, but that the regrowth of skills points in a different direction. For example, the number of doctoral students in the field is decreasing.

Read the full report further down on the page

Life science is a Swedish area of strength. Long-term investments in research and innovation create the conditions for Sweden to be an attractive country for investments, talents and international collaborations. Recurring surveys give us a deeper understanding of the sector and are an important basis for strategic decisions that can contribute to the long-term strengthening of Sweden as a leading life science nation.

Access to the right skills is crucial for companies to be able to grow and develop in Sweden.

During the year, Vinnova has worked on developing a long-term and highly automated method to identify, describe and enable continuous statistical follow-up of the company population within the life science sector. This report is the first produced using the newly developed method. In parallel with the mapping, we further develop the method to make the statistics even more relevant and useful.

Why is this work important? Frida Lundmark, expert in life science at the Pharmaceutical Industry Association (Lif):

Frida Lundmark, expert in life science at the Pharmaceutical Industry Association (Lif)

- Life science is an important sector for Sweden and the pharmaceutical industry accounts for a significant part of Sweden's exports. The government's ambition for Sweden to be a leading life science nation places eligibility requirements on being able to continuously follow and analyze the development of companies in the life science sector. Att Vinnova releasing this first report is very welcome. It provides the opportunity to ensure that investments and ventures contribute to strengthening and developing the industry.

Björn Arvidsson, business manager in life science at the collaborative platform STUNS agrees:

- The life science sector is one of Sweden's absolute areas of strength. That research at our universities gets the chance to be commercialized, grow in our innovation support systems, create jobs, export values and attract talent, capital and establishments is our most important growth engine, he believes.

Björn Arvidsson, operations manager in life science at the collaboration platform STUNS - for co-creation around new opportunities between universities, business and society.

We need strategies to convince them why they should work in Sweden.

The sector is growing - the regrowth of skills is decreasing

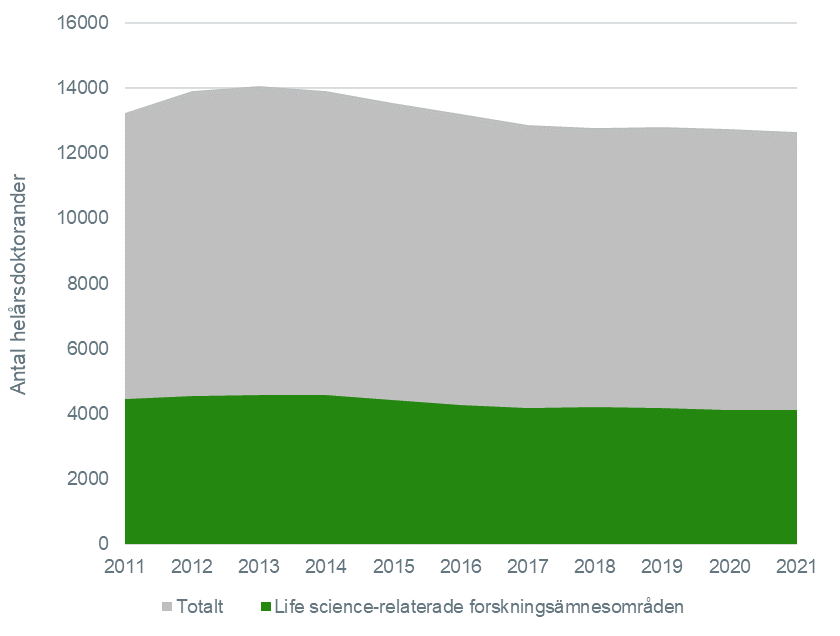

In 2021, one third of all doctoral students in Sweden were in just life science-related research. Yet these were fewer than ten years earlier. This is despite the fact that life science companies have become more numerous and are significantly increasing their turnover. The statistics also show that, throughout the period, it is women who are to a greater extent doctoral-educated within life science companies in Sweden and at Swedish universities.

To this can be added that the number of doctoral students at Swedish universities has generally fallen during the years 2011 to 2021.

How do you see the growth in skills in relation to how the sector is growing?

- The need for competence is changing skin and taking new forms, says Björn Arvidsson. We are in the middle of the fourth industrial revolution, where technical, biological and digital technologies are creating new rules of the game and industry definitions. New skills are needed where, for example, more IT and digital skills are highly valued in all parts of the world.

- Here we need strategies to convince them why they should work in Sweden and why they should contribute to the development of, among other things, life science and, by extension, our health.

Swedish companies in global competition

Frida Lundmark emphasizes the importance of attracting the right skills in the global competition.

- That we can attract experts and cutting-edge expertise to Sweden is important to ensure a viable life science industry. Today, it is difficult for many companies to find the right skills in Sweden.

- Life science companies represent a knowledge-intensive industry and access to the right skills is crucial for the companies to be able to grow and develop in Sweden. This type of report is an important part of clarifying the importance of life science companies for Sweden, but also what challenges the companies have and which need to be addressed so that we do not lose ground in the global competition.

Today, it is difficult for many companies to find the right skills in Sweden.

Strongly increased turnover

In 2020, the Swedish life science sector consisted of roughly 51,700 employees in 3,340 companies.

The companies had a net turnover of almost SEK 365 billion in 2020 - an increase of just over SEK 158 billion since 2014.

It was the large life science companies that accounted for the largest increase in absolute numbers. During the years 2017–2020, their net sales increased by SEK 95 billion (73 percent). During the same period, small businesses increase their net sales by 45 percent.

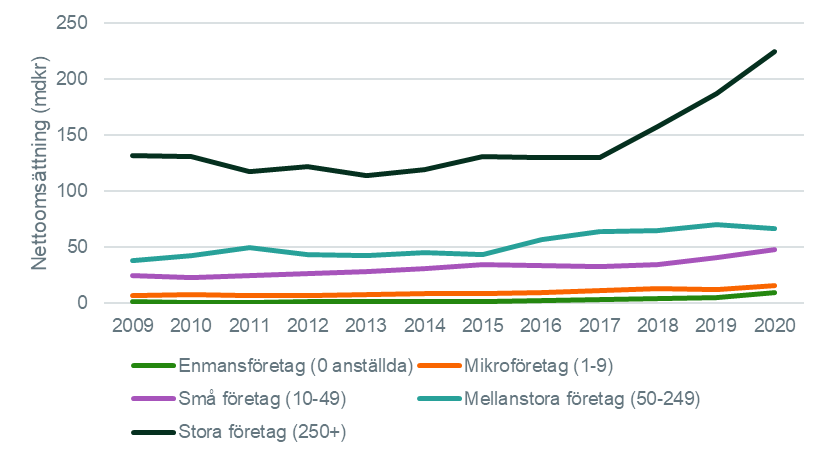

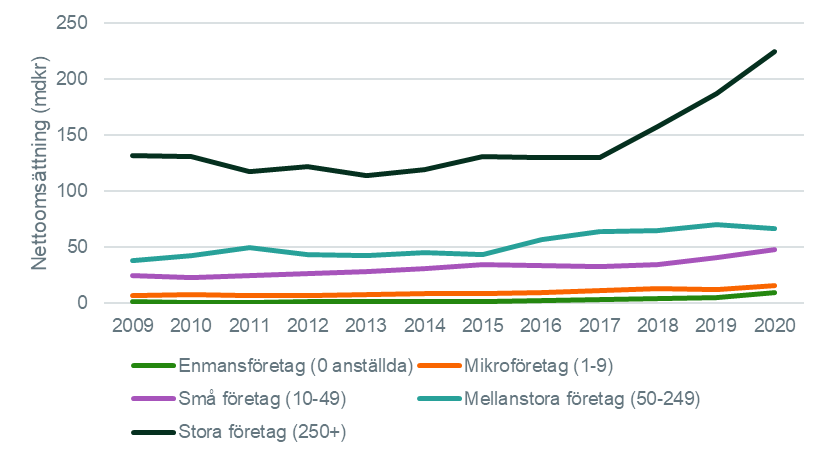

In the figure below, it can be seen that there is an increase in the net turnover within all size classes of companies between the years 2009 and 2020. Looking at medium-sized companies, their increase during the same period is significantly smaller, but if you look at the period from 2015 to 2020, medium-sized companies increase their net turnover by 23 SEK.9 billion (55.0 percent).

Development of net sales in billions of kroner in the life science sector in different size classes in 2009–2020

Significantly more small and medium-sized companies

The number of companies in the life science sector has also increased significantly between 2009 and 2020.

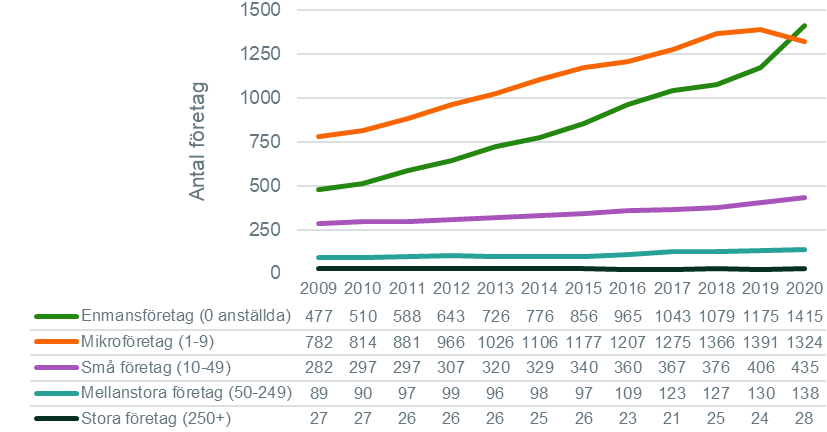

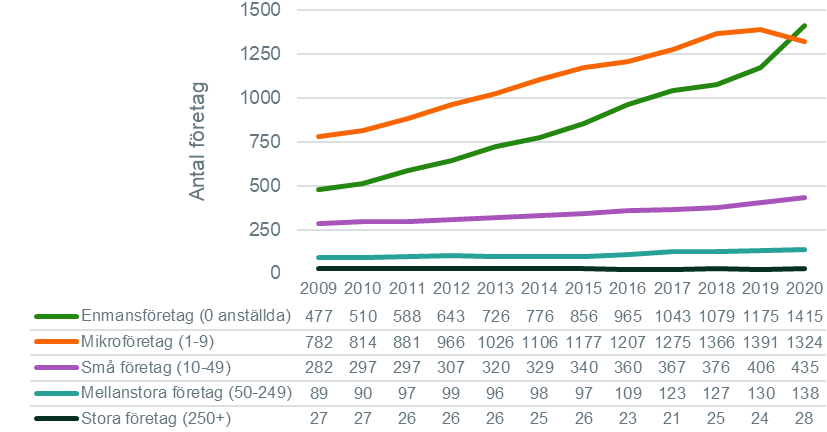

It is not the large companies with more than 250 employees that are increasing. They were roughly the same number during the period 2009-2020. This despite the fact that turnover in these companies increased by 73 percent between the years 2017 and 2020 alone.

Instead, it is sole proprietorships that account for the largest increase over the past ten years. The number of sole traders tripled from 477 to 1,415 during the period. Micro-enterprises with 1-9 employees almost doubled between 2009 and 2020 (from 782 to 1,324). The medium-sized companies also became significantly more (from 50 to 249 employees), especially during the years 2015-2020 when they increased from 97 to 138.

The figure below shows that it is the very smallest life science companies that have increased the most in number.

Development of the number of companies in the life science sector in the years 2009–2020 divided into size categories

The number of doctoral students is decreasing

The general level of education among employees in the life science sector has also increased.

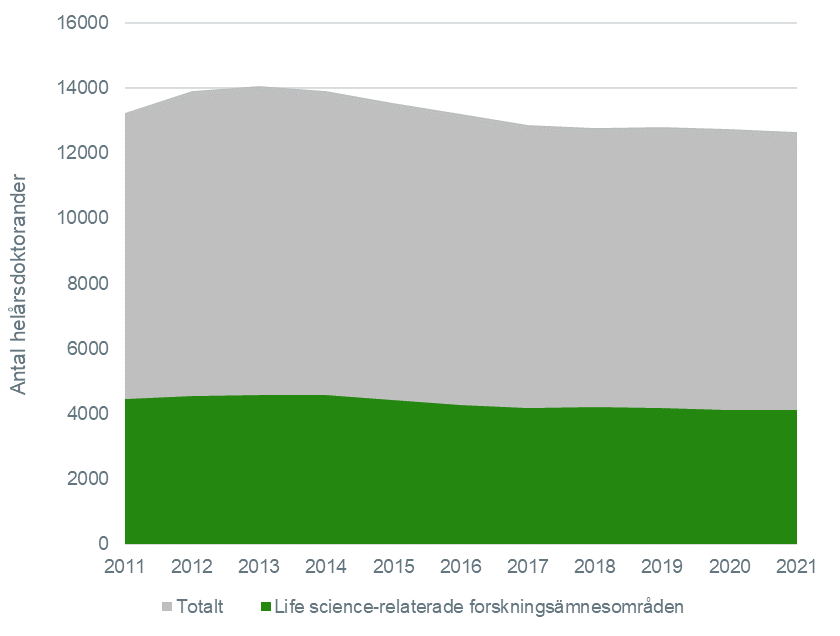

On the other hand, there is a clear trend that the number of PhD students in life science is decreasing at Swedish universities and university colleges. The higher level of education has thus fallen at the same time as the number of companies and the sector's total turnover has increased.

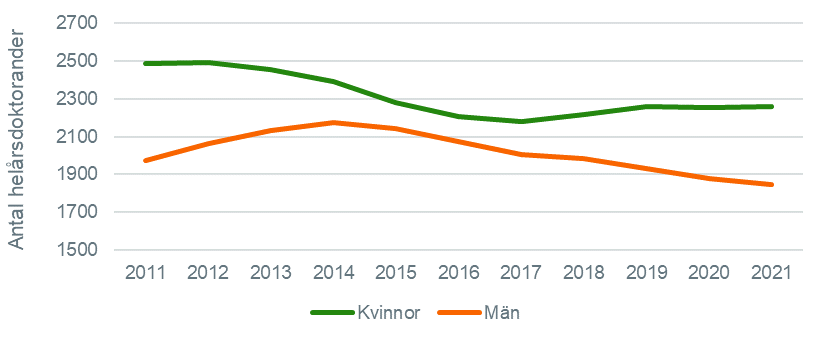

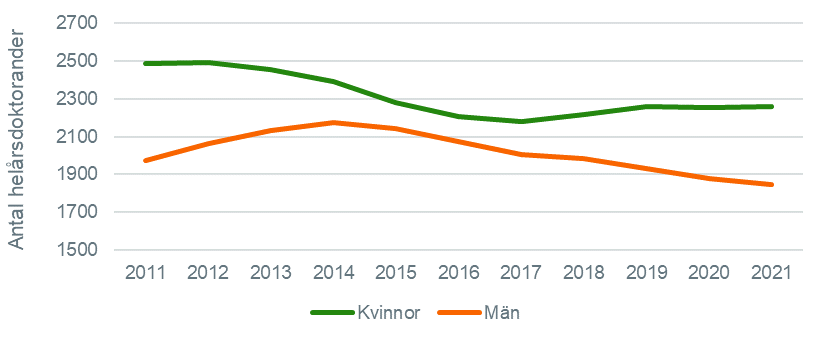

The figures below show that the number of doctoral students at Swedish universities decreased, both in total and within life science-relevant research areas during the years 2011 to 2021. The figure below also shows that the proportion of female doctoral students in life science is stably higher than the proportion of men. Women are to a greater extent trained as researchers in the life science companies. 9.2 percent of women have a postgraduate degree compared to 8.6 percent for men. This can be compared with 1.1 percent for women and 1.5 percent for men in 2020, viewed across Sweden's total working population aged 15-64 years.

In 2021, doctoral students in life science-relevant research areas made up approximately one third of all doctoral students at Swedish universities.

Majority of women among doctoral students in life science at Swedish universities 2011-2021:

Number of doctoral students at Swedish universities, in life science-related research subject areas, divided by gender, for the years 2011–2021. Source: UKÄ

Total number of doctoral students at Swedish universities 2011-2021:

Number of doctoral students at Swedish universities in total and within life science-related research subject areas, for the years 2011–2021.Source: UKÄ